Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Is exempt from income tax.

New Tax Preferences To Support Ukraine Kpmg Poland

The Inland Revenue Board IRB or Lembaga Hasil Dalam Negeri Malaysia LHDN has announced that e-Filing submissions for Income Tax Returns for the 2021 year of assessment YA 2021 will start from March 1.

. UNICEF Malaysia adheres to a strict policy regarding donor. EXEMPTION OF INCOME OF REPRESENTATIVES OF CLUBS ETC. Check more flip ebooks related to 475929704-Income-Tax-2019-Banggawan-SolMan-pdf of busaingchristina001.

Employers are eligible for tax deduction under Public Ruling No. For every donation of RM50 and above it is also tax exempt under Section 446 of the Income Tax Act 1967. In 2020 Griffin took a more central role in opposing Pritzkers goals contributing millions to beat back a ballot initiative that would have amended the states flat-rate income tax to make it a.

When payment is made to the second category you need to first find out the maximum. If you are a one-time donor you will receive a donation receipt from UNICEF for every donation you make. Introduction to Monthly Tax Deduction MTDPCB Part 1 of 3.

Hence all the tax exemption on allowances benefit-in-kind and perquisites must be excluded in this case. PCB is deducted from the employees taxable income only. The remuneration paid by the State to a non-resident as a Commissioner under the Commissions of Inquiry Act 1951 is exempt from income tax or salary and wages tax.

However there are tax deductions. 32019 of Inland Revenue Board of Malaysia. Important examples include the following.

Stamp tax is payable on a wide variety of transactions and documents at rates that may be set in specific amounts or on a percentage basis. Indian Donors will get instant Tax Exemption Receipts their email address. These tax incentives appear in various forms such as EXEMPTION ON INCOME EXTRA ALLOWANCES ON CAPITAL EXPENDITURE INCURRED DOUBLE DEDUCTION OF EXPENSES SPECIAL DEDUCTION OF EXPENSES PREFERENTIAL TAX TREATMENTS FOR PROMOTED SECTORS EXEMPTION OF IMPORT DUTY AND EXCISE DUTY Malaysia offers a wide range of tax incentives for the promotion.

Just claim 100 or 50 of the donation amount subject to taxable income. As long as youve earned an annual income of RM34000 or more for the year 2021 theres no escaping taxes. ECFSINDACDACMBMF Donation Fund Contribution Rates 2015-2022.

Income tax season is upon us. Eligible if the payment of compensation is due to ill health or termination after 172008 with an exemption of RM 10000 for every completed year of service with the same employersame groups companies. Donation to NGO.

This British overseas territory and island nation applies no income tax capital gains tax no corporate income tax inheritance or gift taxes land or housing taxes wealth tax sales tax or VAT. View flipping ebook version of 475929704-Income-Tax-2019-Banggawan-SolMan-pdf published by busaingchristina001 on 2020-10-02. While getting a work permit in the BVI can be a rather bureaucratic process obtaining a residence visa as a self-sufficient person is quite easy.

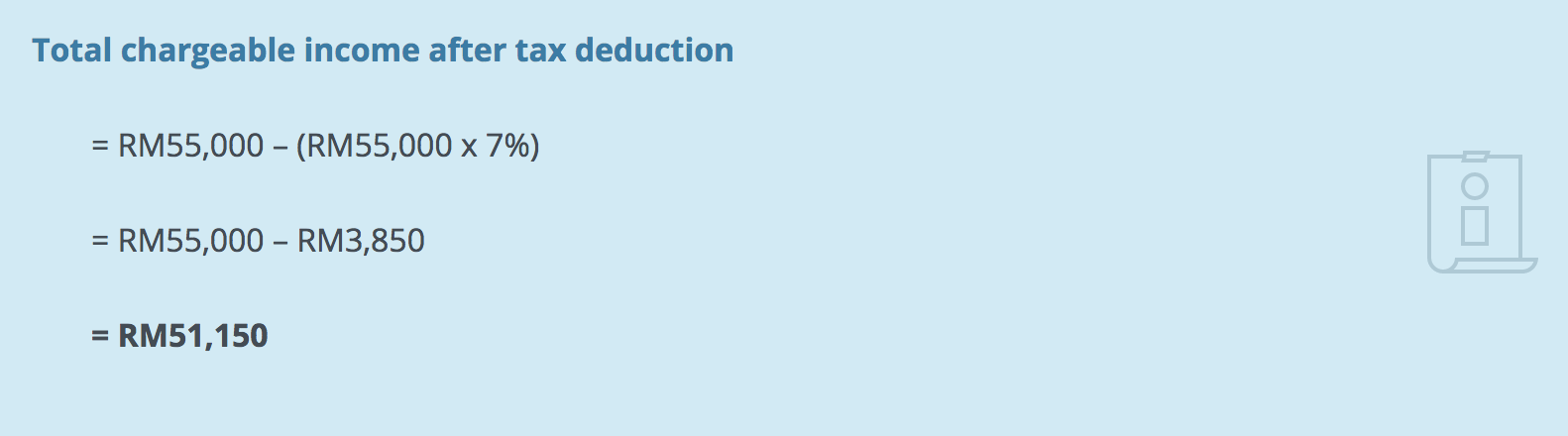

Donations to SERUDS Charity will be eligible for 50 tax exemption under Section 80G of Income Tax Act. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus. Sir I am NRI my whom is living in india received a letter of IT office which details are FY 2012-13 Information Code CIB-410 Information Description _ Deposit in cash affregating Rs 200000- or more with a banking company and FY 2012-13 TDS-194A and asked my wife to file income tax return for 2013-14.

Exemption or reduction of the IMT rate regarding the acquisition of property that constitutes eligible investment under the RFAI. Will my credit card and bank account information remain confidential. In addition the tax credit is not limited to 25 of the donating companys gross tax payable less the deductions for international double taxation and tax relief for income obtained in Ceuta and Melilla for export activities and for local public services which is applicable for other tax credits see CIT relief in the Tax credits and.

She never filed income tax return. EXEMPTION OF REMUNERATION PAID TO NON-RESIDENT MEMBER OF COMMISSION OF INQUIRY. Interested in flipbooks about 475929704-Income-Tax-2019-Banggawan-SolMan-pdf.

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

26 Tax Saving Moves They Are Legal And Permitted By Inland Revenue Board Irb Ppt Download

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Donation Faq Sarawak Children S Cancer Society Sarawak Children S Cancer Society

New Tax Preferences To Support Ukraine Kpmg Poland

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia